Recent Posts

Lake Tahoe Short Term Rental Permit

What Are HOA Rules in Incline Village? A Complete Guide for Homeowners

Investing in North Lake Tahoe Vacation Rentals

Breakfast Places in Tahoe City

Hot Tub Etiquette

Tahoma Restaurants

Follow Us

Gallery

- Posted by Murat Gocmen

- On

How to Value a Vacation Rental Property in 2025

Valuing a vacation rental property involves more than just looking at the purchase price or size; it’s about understanding its income-generating potential. Unlike traditional real estate, vacation rentals are judged based on performance metrics like occupancy rate, average daily rate, and net operating income. Location plays a major role too; properties near popular attractions or seasonal destinations often command higher rental income.

You also need to factor in maintenance costs, management fees, taxes, and compliance with local short-term rental regulations. Getting an accurate valuation helps determine whether the investment will yield positive returns or become a financial burden. It’s a critical step for buyers, current owners, and anyone looking to maximize profitability in the short-term rental market.

What Does It Mean to "Value" a Vacation Rental Property?

To “value” a vacation rental property means determining how much it’s worth based not only on traditional real estate factors but also on its income-generating potential. In contrast to a primary residence, where value is tied mainly to the structure, location, and recent comparable sales, a vacation rental’s value is largely influenced by how much rental income it can produce.

Key elements include the average daily rate (ADR), occupancy rate, seasonal trends, and overall demand in the area. In popular destinations, even a modest home can hold significant value if it’s consistently booked and delivers strong returns. Investors also consider long-term appreciation potential, maintenance costs, and legal considerations such as zoning laws and short-term rental permits.

Accurate valuation helps investors avoid overpaying, set realistic expectations, and make data-backed decisions. Ultimately, it’s about balancing property value with income performance to assess the true financial viability of the investment.

Why Is It Important to Properly Value Your Vacation Rental?

Proper valuation helps you:

- Avoid overpaying when purchasing

- Attract financing or investment partners

- Accurately assess ROI and cash flow

- Price the property effectively if you plan to sell

Failing to do so can lead to poor investment decisions, underperformance, or costly surprises down the road.

What Factors Affect the Value of a Vacation Rental Investment?

Location & Demand

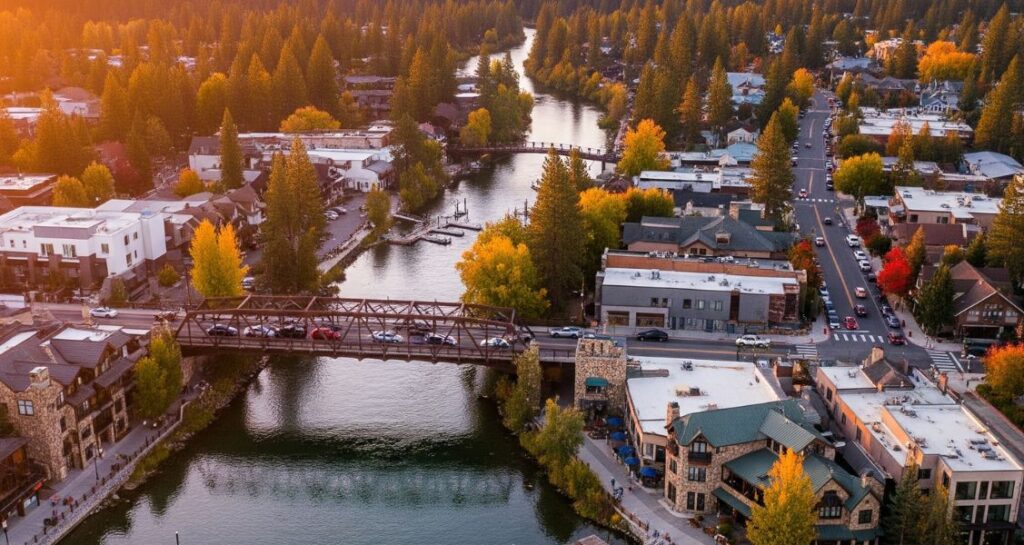

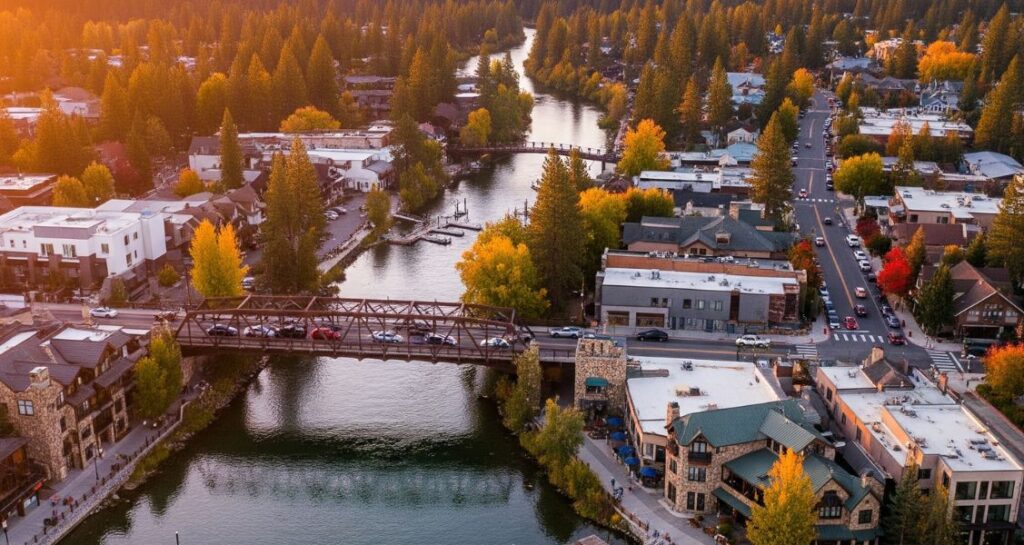

Location is one of the most significant value drivers for vacation rentals. Properties near popular destinations like beaches, ski resorts, lakes, or national parks naturally attract higher demand. Scenic elements such as lakefront or mountain views enhance appeal. Local tourism trends, including seasonality and year-round visitor interest, also affect occupancy rates and income potential. A well-located rental in a high-demand area can consistently generate bookings, making it a more valuable asset in both the short and long term.

Property Type & Condition

The property’s physical characteristics and upkeep directly impact its desirability. Larger homes with multiple bedrooms, open layouts, and updated interiors are ideal for accommodating families or groups. Well-maintained homes that feature high-quality amenities like hot tubs, pools, game rooms, or lake access often command higher nightly rates. Furnishings, appliances, and décor should be modern and durable. A clean, attractive space not only justifies premium pricing but also encourages positive reviews and repeat bookings.

Rental Performance

Analyzing a property’s past and projected rental performance is essential. Key metrics include occupancy rate (the percentage of booked nights), ADR (Average Daily Rate), and annual revenue, both gross and net after expenses. These figures reveal how well the property is monetized. A vacation rental with high occupancy, strong nightly rates, and consistent earnings is far more valuable than one with irregular income. Investors use these performance indicators to estimate potential return on investment and long-term profitability.

Reviews & Guest Experience

The guest experience influences not just revenue but also long-term property value. Properties with high star ratings and glowing reviews on platforms like Airbnb, Vrbo, or Google are more likely to attract new guests and earn repeat business. Excellent hospitality, cleanliness, and thoughtful touches enhance satisfaction. Frequent positive feedback helps maintain consistent occupancy and allows hosts to justify higher pricing. A strong online reputation translates into higher perceived value and increased trust from prospective renters.

Legal & Regulatory Compliance

Compliance with local regulations is non-negotiable for valuation. A valid short-term rental license or permit ensures the property is legally operable. Zoning laws, HOA restrictions, and occupancy limits vary by area and can affect the rental’s usability. Taxes, such as the transient occupancy tax, must also be considered. Failing to comply with legal requirements can result in fines or shutdowns, negatively impacting both income and value. A compliant, regulation-ready property is more attractive to buyers and investors.

How to Calculate the Value - Key Methods

-

Income Approach (Cap Rate Method)

This method is ideal for income-producing properties.

Formula: Property Value = Net Operating Income (NOI) ÷ Capitalization Rate (Cap Rate)

Example:

- Annual Rental Income: $90,000

- Operating Expenses: $30,000

- NOI = $60,000

- Cap Rate = 8%

- Estimated Value = $60,000 ÷ 0.08 = $750,000

This method emphasizes profitability and works well in active markets.

-

Comparative Market Analysis (CMA)

Look at recent sales of similar vacation rental properties nearby.

What to look for:

- Similar size, amenities, and location

- Rental performance of comps if available

- Adjustments for differences (views, condition, proximity)

This is useful when you have strong local knowledge or realtor support.

-

Gross Rent Multiplier (GRM)

A quick way to estimate value using gross income.

Formula: GRM = Property Price ÷ Gross Annual Rental Income

Example:

- Property Price = $700,000

- Annual Gross Income = $100,000

- GRM = 7.0

Lower GRM often suggests a better deal, but this doesn’t factor in expenses.

-

Discounted Cash Flow (DCF) Method

This method calculates the present value of expected future cash flows.

Used by experienced investors, it considers:

- Annual projected income

- Operating costs

- Vacancy rates

- Exit value after 5–10 years

- Discount rate (typically 8% to 12%)

It’s the most accurate but also the most complex.

Where to Find Reliable Data for Valuation

AirDNA:

AirDNA offers detailed analytics on Airbnb and Vrbo listings, including occupancy rates, average daily rates, and seasonal trends. It helps investors assess how similar vacation rentals perform in a specific market, making it a valuable tool for predicting income potential and evaluating property performance.

Mashvisor:

Mashvisor provides in-depth investment property analysis, helping buyers compare long-term vs. short-term rental returns. It includes cap rates, cash flow estimates, and neighborhood performance data, making it easier to identify high-yield opportunities and assess if a vacation rental aligns with your investment goals.

Zillow & Realtor.com:

These platforms offer up-to-date information on property values, market trends, and comparable sales. While not specific to short-term rentals, they’re useful for gauging property appreciation potential and understanding the pricing landscape in a given area, especially when used alongside other STR-focused tools.

STR Management Software:

Short-Term Rental (STR) management software like Hospitable or OwnerRez provides real-time booking, revenue, and occupancy insights. It helps hosts track performance metrics, manage calendars, and optimize pricing, valuable for owners wanting accurate data to support valuations or project future income.

Local Real Estate Agents:

Local agents bring knowledge of neighborhood comps, regulations, and tourism trends. They offer expert insight on zoning laws, permitting requirements, and market demand, especially helpful when evaluating if a property will be viable or restricted as a vacation rental in a particular location.

Common Mistakes to Avoid When Valuing a Vacation Rental

Ignoring local regulations:

Overlooking local zoning laws, permit requirements, or short-term rental (STR) bans can lead to hefty fines or business shutdowns. Always research city and county rules before purchasing or operating a vacation rental to avoid legal pitfalls.

Overestimating occupancy or ADR:

Projecting overly optimistic occupancy rates or average daily rates (ADR) without solid data can inflate your expected returns. Rely on market research and tools like AirDNA to generate realistic forecasts based on similar properties.

Not factoring maintenance:

Vacation rentals with extras like hot tubs, pools, or fireplaces often require frequent upkeep. Snow removal, pest control, and cleaning between guests also add recurring costs that must be factored into your valuation and profit margins.

Relying only on peak season data:

Peak-season performance can be misleading if off-season demand is weak. Valuing a property based solely on summer or holiday revenue ignores annual cash flow fluctuations and leads to inaccurate expectations for long-term profitability.

Should You Hire a Professional Appraiser or Do It Yourself?

Hire a Pro When:

- Applying for an investment loan or refinancing

- Purchasing a high-value or complex property

- Needing an expert opinion for legal or partnership decisions

DIY is OK When:

- You’re buying a low-risk or entry-level rental

- You have access to accurate market data and tools

- You’re already experienced with STR metrics

How Often Should You Re-Evaluate Rental Property?

- Annually: Review performance and update valuation

- After major upgrades: New hot tub, remodel, or additional bedroom

- During refinancing: Required by banks or lenders

- Before resale: Helps set competitive market pricing

FAQs About Valuing a Vacation Rental Property

How do I know if I’m overpaying for a vacation rental?

How do I know if I’m overpaying for a vacation rental?

Run the income approach and compare with local comps. If the expected ROI or cap rate is low, you may be overpaying.

Are vacation rentals a good investment?

Are vacation rentals a good investment?

Yes, investing in vacation rental properties can be a good investment if done wisely. They offer strong income potential, especially in high-demand areas, but success depends on smart management, location, and understanding local regulations and seasonality.

How to estimate short term rental income?

How to estimate short term rental income?

To estimate short-term rental income when investing in vacation rentals, calculate expected occupancy rates and average nightly rates based on similar listings in the area. Use tools like AirDNA or Mashvisor to get accurate, data-driven projections.

Can I use Zestimate or Redfin to value a rental?

Can I use Zestimate or Redfin to value a rental?

Not reliably. These tools are built for primary homes, not income-generating STRs.

What’s a good cap rate for vacation rentals?

What’s a good cap rate for vacation rentals?

It depends on the market, but 7% to 10% is often considered healthy for STRs.

Do platforms like Airbnb or Vrbo affect valuation?

Do platforms like Airbnb or Vrbo affect valuation?

Yes. High reviews, visibility, and booking history on these platforms boost perceived value.

What role do cleaning and maintenance costs play in value?

What role do cleaning and maintenance costs play in value?

They impact your net income, so higher expenses reduce NOI and ultimately property value.

Summary

Understanding how to value a vacation rental property is essential for making informed investment decisions. By using a combination of methods from cap rate to comps to DCF and leveraging reliable tools, you can confidently estimate your property’s worth. Avoid common pitfalls, factor in all expenses, and re-evaluate regularly to stay ahead in the vacation rental market. A well-valued property not only maximizes returns but also gives peace of mind to investors looking for both profit and long-term security.